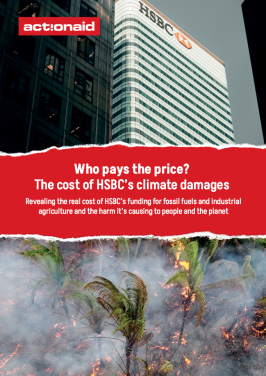

Who pays the price? The cost of HSBC’s climate damages

Year on year, the climate crisis continues to worsen, with disproportionately negative impacts on countries in the Global South that have contributed the least to global emissions. Within these countries, women and girls bear the brunt of these impacts.

It has never been more critical for Governments to act to cut emissions and prevent further global heating and destruction. This report looks into how a lack of financial sector regulation means private finance continues to flow to the problem, with billions of dollars pumped by banks into climate-harmful industries each year, particularly fossil fuels and industrial agriculture.

Executive summary

In this new report, ActionAid UK investigates the costs to people and the planet resulting from HSBC’s financing of these industries. In the period 2021-2023, this report finds that HSBC provided £153 billion in financial flows to fossil fuel and industrial agriculture sectors. As a result of these financial flows, HSBC has generated 357 million tons of Carbon dioxide equivalent (CO2e). The societal costs of these emissions – using the Societal Costs of Carbon methodology - are calculated at £128 billion in climate damages, equivalent to three times HSBC’s accumulated net profit in this period.

HSBC’s financial flows to companies active in the Global South is also linked to human rights and environmental harm. Stories of harm emerge from communities, particularly women and girls, impacted by extractive activities in Bangladesh, Brazil and Tanzania. These impacts vary from case to case but taken together include deforestation, land grabbing, displacement of communities, risks to loss of biodiversity, violations of rights of indigenous people and local communities, gender-based violence, and pollution leading to health issues.

HSBC’s policies on fossil fuels, industrial agriculture, and human rights are insufficient in addressing the climate crisis and the direct impacts of these sectors. In addition, the UK’s inadequate regulatory landscape permits UK banks to continue financing fossil fuel and industrial agriculture sectors, fuelling the climate crisis with harmful impacts on women and girls.

Who pays the price? The cost of HSBC's climate damages full report

Who pays the price? Advocacy brief

Who pays the price? Report Annexes

Who pays the price? Executive summary